A northeastern Ontario cesium exploration company, recently forced by Ottawa to ditch its Chinese financier, has apparently found a replacement investor.

Power Metals Corp. announced that Winsome Resources of Australia has stepped in to acquire the TSX-V-listed shares currently held by Hong Kong-based Sinomine Rare Metals Resources.

Power Metals and Sinomine were among three Hong King and Chinese-financed exploration partnerships named by Innovation Minister François-Philippe Champagne in early November as being forced to withdraw its foreign investment in the exploration work taking place at the Case Lake Project, located near the Quebec border.

National security has been cited as a reason for Ottawa’s clampdown on foreign investment in domestic natural resources projects by countries deemed by Ottawa as hostile to Canada's interests.

Earlier this year, Sinomine made an equity investment of $1.5 million into Power Metals as part of negotiating an offtake agreement, signed last March, to purchase all the production from Case Lake should the property go into commercial production as a mine.

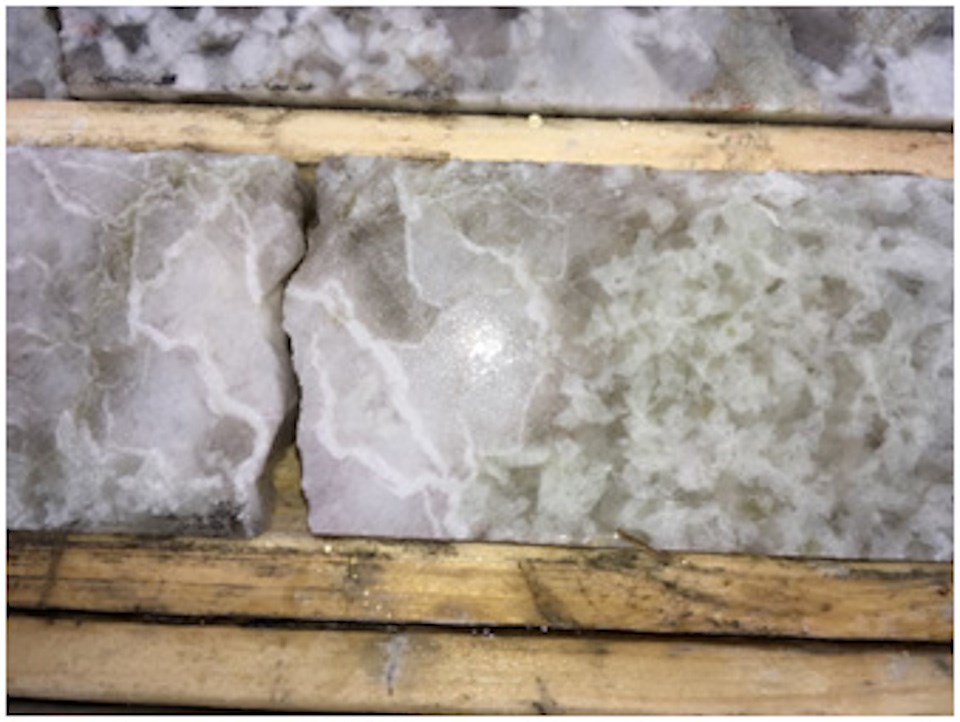

But this arrangement concerned Ottawa. Power Metals’ Case Lake Project is said to host high-grade deposits of cesium, lithium and tantalum, all categorized by the Canadian and U.S. governments as being on the critical minerals list.

Winsome is an emerging lithium mine developer with exploration assets on the Quebec side of the James Bay region. The company is listed on the Australian Securities Exchange.

A 13,000-metre exploration drilling program is taking place at Case Lake to come up with a first-time mineral estimate. The project is 80 kilometres east of Cochrane and is road accessible by the Translimit Road which runs between Ontario and Quebec.

For $2 million, Winsome acquires 7,500,000 common shares in Power Metals and the same amount of share purchase warrants, which can be converted into shares.

In a statement, Winsome Resources Managing Director Chris Evans called it “an exciting opportunity” to expand its critical minerals interest into a neighbouring province.

“The Case Lake Project is located in relatively close proximity to a number of our assets, in particular Mazerac and Decelles, with similar geological characteristics and strong drill results showing high-grade caesium, lithium and tantalum mineralization.

"The minerals are all in high demand within North America and the rights to the offtake agreement are another positive step in the Winsome journey. We look forward to working with Power Metals to assist in developing this impressive project."