NEWS RELEASE

HARTE GOLD SUGAR ZONE MINE

**************************

Harte Gold is pleased to provide the following update on its commercial operations and exploration activities.

Highlights

- The Sugar Zone Mill complex is achieving consistent throughput of 575 tonnes per day. Over 24,000 tonnes of material has been processed through the mill year-to-date. The Company is on track to declare commercial production by year-end.

- A flotation concentrate at higher than expected grades is being shipped to the Horne Smelter for processing. Gold is also is being recovered through a gravity circuit at site and shipped in the form of doré bars.

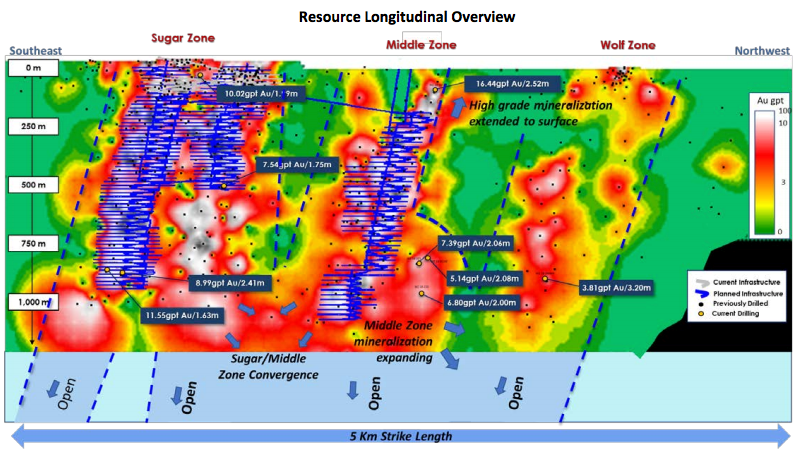

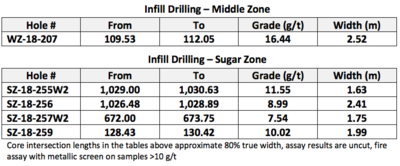

- High grade mineralization at the Middle Zone has extended to near surface. Hole WZ-18-207 returned 16.44 g/t over 2.52 metres at 100 metres.

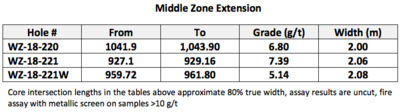

- Mineralization of the Middle Zone has extended 250 metres along strike at 750 metres below surface, converging with the Wolf Zone at depth. Hole WZ-18-220 returned 6.80 g/t over 2.00 metres, hole WZ-18-221 returned 7.39 g/t over 2.06 metres and hole WZ-18-221W returned 5.14 g/t over 2.08 metres.

- Infill drilling is now complete and a NI 43-101 Mineral Resource Estimate is being prepared on the basis of drilling completed in 2018. Based on assays received to-date, the Company expects a significant upgrade in the tonnes and grade of Indicated Mineral Resources. The Company is targeting to announce an updated Mineral Resource Estimate in Q1 2019.

- An agreement has been reached with Appian Natural Resources Fund (“Appian”) to extend the US$20 million subordinated loan facility to May 9, 2019 on similar terms and conditions. The Company will provide further details on the extension upon execution of the agreement and subject to exchange approval.

Stephen G. Roman, President and CEO, commented, “We are extremely pleased with the Harte Gold operations team and Halyard Inc., who have turned this mill on and made it run without any major issues. Congratulations.” Mr. Roman added, “Middle Zone expansion reinforces the Company’s belief that the Sugar, Middle and Wolf Zones are fed from a much larger system converging at depth. We plan to continue testing this theory with further exploration in 2019, assisted by downhole geophysics.”

Operations update

Operations at the mill have been stabilized and the Company is achieving its permitted throughput target of 575 tpd. The mill is currently being fed from higher grade underground material and the surface stockpile, but will transition solely to underground material by early 2019.

Mine planning for 2019 and life-of-mine is underway and will incorporate a significant amount of definition drilling completed in 2018 which was not included in the Preliminary Economic Assessment (“PEA”). The Company will provide further guidance when this work is complete, targeted for the beginning of 2019.

Middle Zone Extension Along Strike The Middle Zone extension was first identified through downhole geophysics carried out by Blaine Webster and Abitibi Geophysics. The information provided led to step-out drilling north of the Middle Zone, 750 metres below surface. Initial results are provided in the following table:

The alteration package is similar to Middle Zone alteration, with expected similar grades and widths. The Company is currently completing additional drilling in the area to expand Inferred Mineral Resources, which will be incorporated in the next NI 43-101 Mineral Resource Estimate.

Sugar and Middle Zone Infill Drilling Infill

Drilling at the Sugar and Middle Zones is now complete and results are being incorporated into an updated Mineral Resource Estimate and future mine planning. Drilling at the Middle Zone has been successful in expanding mineralization towards surface. Hole SZ-18-207 returned high grade mineralization at the north limb of the Middle Zone in an area previously not included in the resource or mine plan. These results add flexibility to near term planning and prioritization of target areas in the early years of mining.

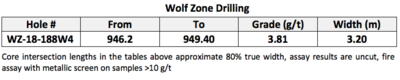

Wolf Zone Drilling Drilling

For 2018 has been successful expanding mineralization at the Wolf Zone approximately 300 metres on strike and 700 metres down dip. The Wolf Zone was previously not included in any resource estimate. The Company also expects to incorporate all the Wolf Zone drilling in the form of Inferred Mineral Resources in the next resource update.

Property Wide Exploration Near-surface drilling has been completed at both the Eagle and Highway Zones. No significant mineralization has been returned to-date, however, these areas will be revisited with geophysics and potential drilling in 2019.

QA/QC Statement The Company has implemented a quality assurance and control (“QA/QC”) program to ensure sampling and analysis of mine and exploration work is conducted in accordance with industry standards. Drill core is sawn in half with one half of the core shipped to Actlabs Laboratories located in Thunder Bay, ON, while the other half is retained at the Company’s core facilities in White River, ON, for future verification. Certified reference standards and blanks are inserted into the sample stream on a regular interval basis and monitored as part of the QA/QC program. Gold analysis is performed by fire assay using atomic absorption, gravimetric or pulp metallic finish. The Mineral Resource Estimate was prepared in compliance with NI 43-101 guidelines. Robert Kusins, P. Geo., Harte Gold’s Senior Mineral Resource geologist, is the Company’s Qualified Person and has prepared, supervised the preparation, or approved the scientific and technical disclosure in this news release.

About Appian Natural Resources Fund (“Appian”)

Appian is a metals and mining private equity fund providing long-term capital to both private and public mining companies. The advisor to Appian Natural Resources Fund, Appian Capital Advisory LLP, is a leading investment advisor in the metals and mining industry, with worldwide experience across North America, South America and Africa and a track record of successfully supporting companies to achieve their development targets.

The loan agreement with Appian is a “related party transaction” as defined in Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is exempt from the requirements to obtain a formal valuation or minority shareholder approval in connection with the financing in reliance on sections 5.5(a) and 5.7(a), respectively, of MI 61-101, as the fair market value of the transaction will not exceed 25% of the Company’s market capitalization calculated in accordance with MI 61-101.

About Harte Gold Corp.

Harte Gold is Ontario’s newest gold producer through its wholly owned Sugar Zone Mine in White River Ontario. Using a 3 g/t gold cut-off, the NI 43-101 compliant Mineral Resource Estimate dated February 15, 2018 contains an Indicated Mineral Resource of 2,607,000 tonnes grading 8.52 g/t for 714,200 ounces contained gold and an Inferred Mineral Resource of 3,590,000 tonnes, grading 6.59 g/tfor 760,800 ounces contained gold. The Company has completed a 100,000 metre drill program on near mine and exploration targets, results of which will be incorporated into an updated NI 43-101 compliant Mineral Resource Estimate and mine plan targeted for Q1 2019. Exploration continues on the Sugar Zone property, which encompasses 83,850 hectares covering a significant greenstone belt.

**************************